reit dividend tax canada

In 2021 revenue at Chartwell declined 24 and net income declined. Investment income is subject to an 8.

Canada Revenue Agency 1 Reit Tfsa Investors Should Buy For Tax Free Income

34 rows The Best 4 Canadian REITs.

. When they flow their income through to their unitholders the REITs dont pay much if any corporate tax. Dividends fromREITs are commonly taxed as ordinary income under a maximum of 37 returning to 3965With 3 additional increases in. The share price is 1368 if you invest today.

Taxpayers who hold Canadian dividend-paying stocks can be eligible for the dividend tax credit in Canada. Sign-up for free today. CrowdStreet makes direct investing in online real estate easy.

Or you can reinvest those dividends. The Canada Revenue Agency applies a 150198 tax on the tax portion of eligible dividends and a 9031 rate on the tax portion of non-eligible dividends. 1 day agoChartwell is a REIT that provides reliable passive income.

Thats 25 for every 10000 invested. This means that dividend income will be taxed at a lower rate. Dividends from REIT companies are taxed at a maximum rate of 37 returning to 39 percent.

REITs pay dividends up to 37 taxed at 38 so they tend to pay more as ordinary income. Costs soared and people were scared. Canada offers special tax treatment for Canadian income trusts.

Preferred Canadian Dividend Tax Rate. CrowdStreet makes direct investing in online real estate easy. In 2026 the deficit will increase to 6 with a separate 3 increase.

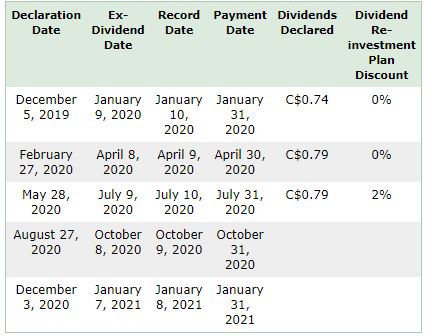

REITs typically pay quarterly dividends most Canadian REITs pay unitholders monthly. Taxable amount of the other than eligible dividends 200 X 115 230. Distributions paid by the REIT to a Canadian unitholder that are made out of the REITs current or accumulated earnings and profits as determined for US.

Chartwell is a REIT that provides reliable passive income. Total taxable amount 276 230 506. Dividends are taxed at a lower rate.

Join thousands of investors. Because of the tax. You will report the total taxable dividends on line 12000.

Choice Properties is a Real Estate Investment Trust that owns manages and develops retail and. A 7 Dividend Stock That Pays Cash Every Month. Join thousands of investors.

710 if shareholder owns at least 10 of the REITs voting stock except in the case of Jamaica and no more than 25 of the REITs income consists of dividends and interest. Ad Over 580 deals funded 3 billion invested on CrowdStreet. Granite REIT is a Canadian-based real estate investment trust engaged in the acquisition development ownership management of logistics warehouse and industrial.

In 2021 revenue at Chartwell declined 24 and net income declined 32. A high-yield and monthly frequency is a combination most commonly found in REITs though sustainability and. Sign-up for free today.

Considering you could buy all 6 stocks through a brokerage like Qtrade for 30 in commission this is a significant jump. To judge the security of the distribution REITs pay distributions not dividends again you can think of them as the same an investor should look at the payout ratio based on. The Canada Revenue Agency applies a 150198 tax on the tax portion of eligible dividends and a 9031 rate on the tax portion of non-eligible dividends.

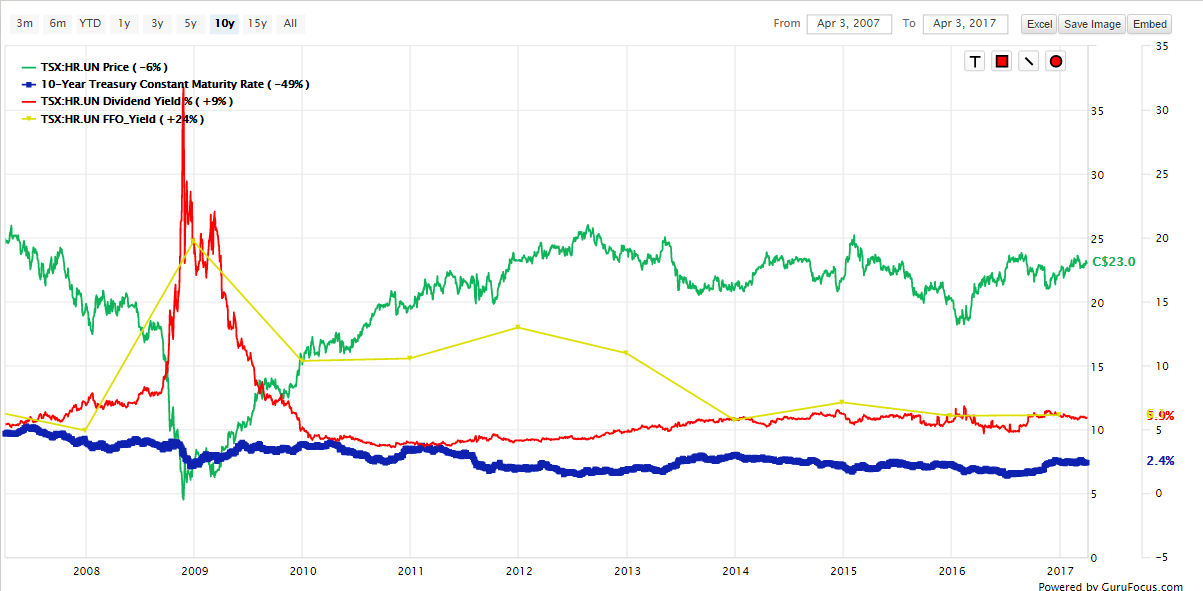

Although the total return 1637 in 2021 isnt comparable to high flyers this REIT pays a high 579 dividend. The fee is reasonable enough and if you invest a substantial amount in this fund you can start a passive income just through dividends. Tax Issues The Canadian government requires that REITs withhold 15 of shareholder.

Federal income tax purposes. Ad Over 580 deals funded 3 billion invested on CrowdStreet. How Is Income From Reits Taxed.

5 rows Canadian Dividends. By 2026 the rate will be 6 plus a third. 23 hours agoDividend stock Chartwell REIT passive income.

5 Best Reit Etfs In Canada 2022 Easily Invest In Real Estate

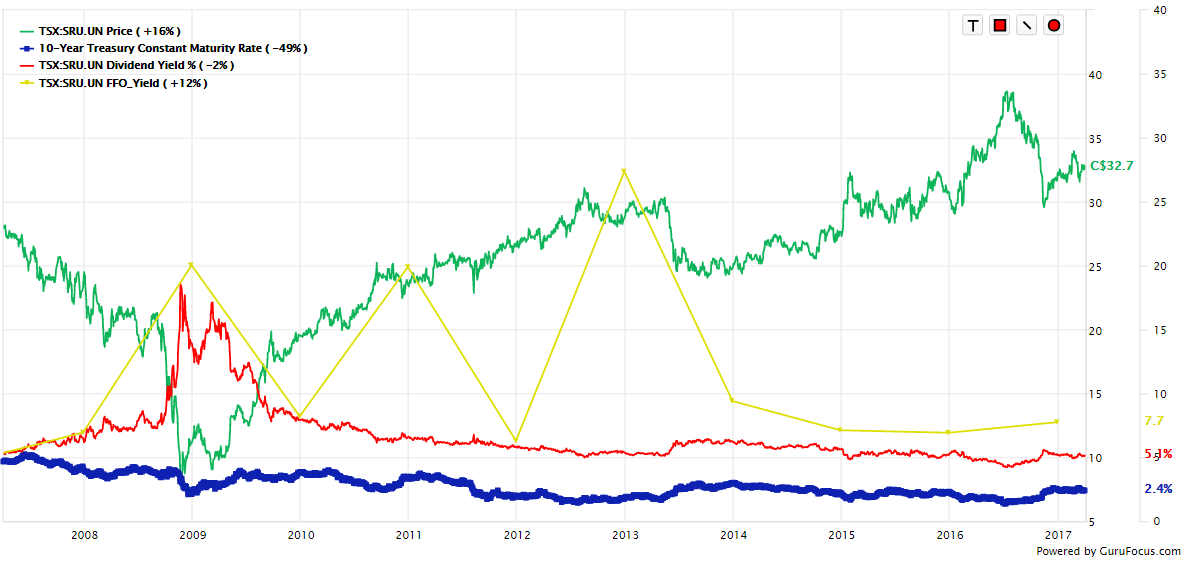

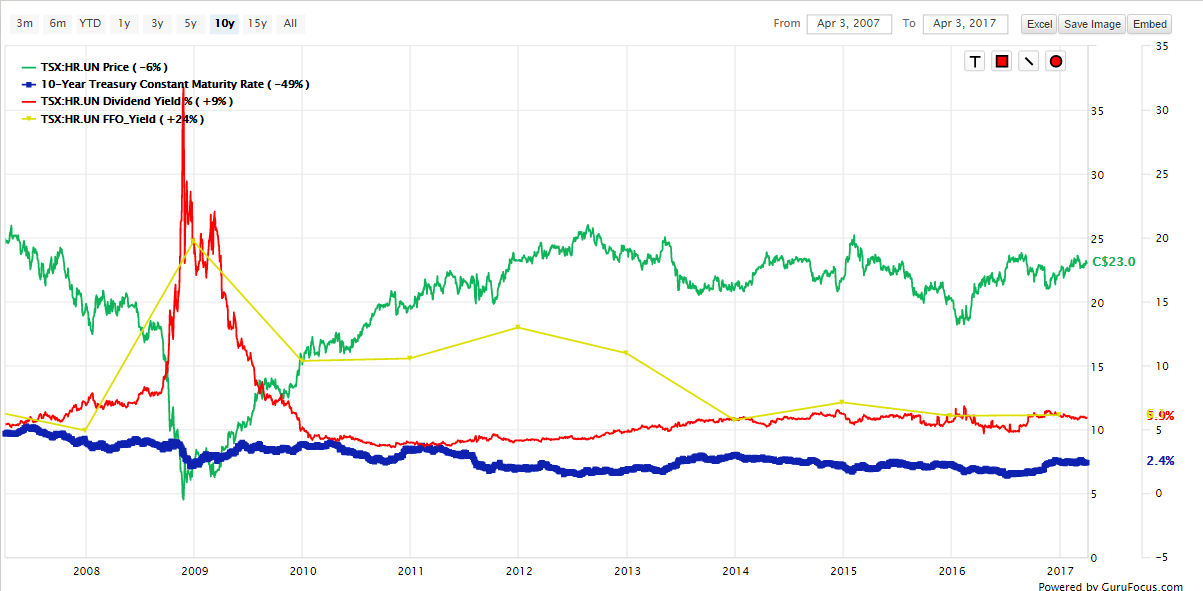

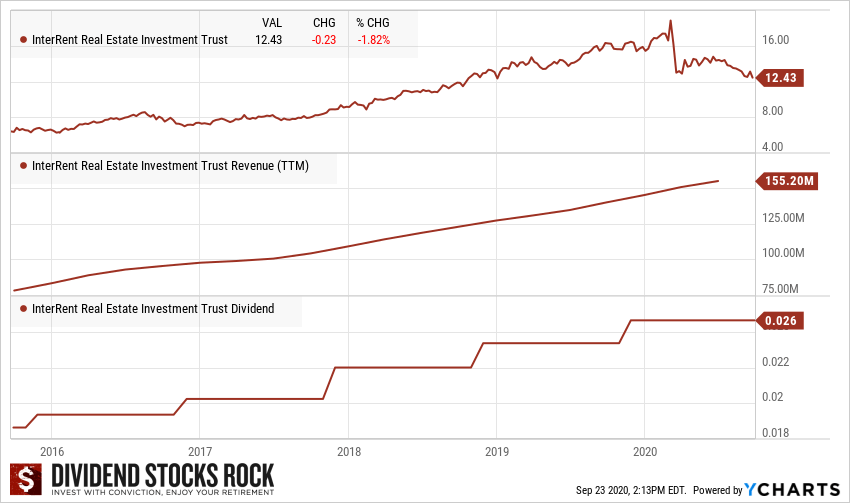

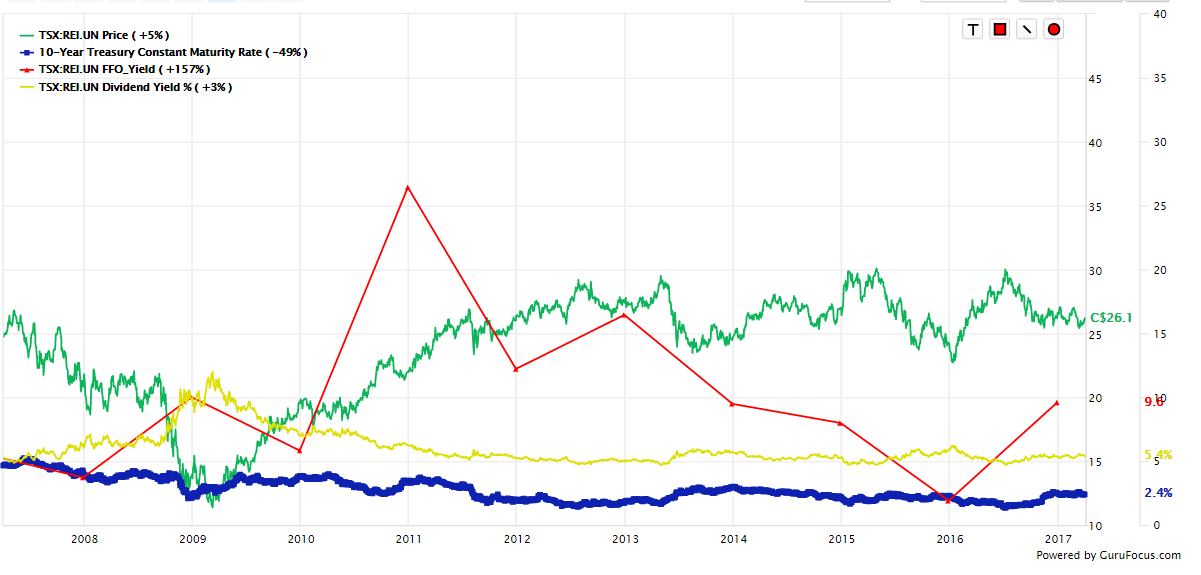

Top 3 Canadian Reits For 2020 And Why Riocan Is Not Part Of It Seeking Alpha

24 Best Canadian Reit Stocks 2022 Invest In Real Estate

Introduction To Canadian Reits Seeking Alpha

Can Reits Replace Investment Properties Financially Yours

Reits Canada Still Offers Tax Advantages For These Investments

Reit Taxation A Canadian Guide

Reit Taxation A Canadian Guide

The 20 Best Dividend Stocks In Canada For 2022 And What To Look For When Dividend Investing Hardbacon

Reits Canada Still Offers Tax Advantages For These Investments

Tfsa Investors This 6 5 Dividend Stock Pays You Every Month

Introduction To Canadian Reits Seeking Alpha

Stock Investors Hungry For Yield Shun Canadian Reits In Downturn Bnn Bloomberg

My Rental Income From 7 Canadian Reits

Dividends A Canadian Dividend Investor S Dream Tawcan

I Did All The Due Diligence For Canadian Reits Based On Their Q2 Reports Take A Look At This Table R Canadianinvestor