portland oregon sales tax 2019

While many other states allow counties and other localities to collect a local option sales tax Oregon does not. Combined with the state sales tax the highest sales tax rate in Oregon is NA in the cities of Portland Portland Salem Beaverton and Eugene and 102 other cities.

Pin On Moving To Portland Oregon

Tax rates last updated in January 2022.

. The minimum combined 2022 sales tax rate for Portland North Dakota is 7. There is no applicable city tax or special tax. The Oregon state sales tax rate is 0.

This is the total of state county and city sales tax rates. What is the sales tax rate in Portland North Dakota. Portland OR Sales Tax Rate.

This is the total of state county and city sales tax rates. Honolulu Hawaii has a low rate of 45 percent and several other major cities including. You can print a 725 sales tax.

The 925 sales tax rate in Portland consists of 7 Tennessee state sales tax and 225 Sumner County sales tax. The Oregon state sales tax rate is 0 and the average OR sales tax after local surtaxes is 0. What is the sales tax rate in Portland Oregon.

The 725 sales tax rate in Portland consists of 575 Ohio state sales tax and 15 Meigs County sales tax. There is no applicable city tax or special tax. 60 for MBA members 95 non-members.

The North Dakota sales tax rate is currently 5. Neither Anchorage Alaska nor Portland Oregon impose any state or local sales taxes. The company is now collecting sales tax for online sales in at.

2022 Oregon state sales tax. 2019 the Clean Energy Surcharge CES is imposed on. On November 6 2018 Portland voters passed Measure 26-201 which imposes a 1 gross receipts tax on large retailers.

Oregon is one of 5 states that does not impose any sales tax on purchases made in. Exact tax amount may vary for different items. Ad Find Out Sales Tax Rates For Free.

Portland Tourism Improvement District Sp. Download PDF file 2019 Arts Tax Return in Vietnamese Tiếng Việt 74651 Kb. The local sales tax rate in Portland Oregon is 0 as of January 2022.

The Portland Oregon sales tax is NA the same as the Oregon state sales tax. For example under the South Dakota law a company must collect sales tax for online retail sales if. Sales Tax Rate Lookup.

Oregon Sales Taxes. The companys gross sales exceed 100000 or. Combined tax rate 0 Local rates are set by the county city or other taxing district.

The 8 sales tax rate in Portland consists of 65 Arkansas state sales tax and 15 Ashley County sales tax. There are no local taxes beyond the state rate. The state sales tax rate in Oregon is 0000.

Josh Lehner a senior economist with the Oregon Office of Economic Analysis compared the citys clean energy tax to Measure 97 a state business tax initiative that went. The tax applies to revenue from all retail sales of. Certain business activities are exempt from paying business taxes in Portland andor Multnomah County.

The County sales tax. You can print a 8 sales tax. The Oregon sales tax rate is currently.

There are six additional tax districts that apply to. 2019 PortlandMultnomah County Combined Business Tax Returns Individuals. This is the total of state county and city sales tax rates.

The current total local sales tax rate in Portland OR is 0000. Sales tax region name. There is no applicable city tax or special tax.

Information about Portland Business License Tax Multnomah County Business Income Tax and Metro Supportive Housing Services. For tax years beginning on or after January 1 2019 the Clean Energy Surcharge CES is a 1 surcharge on Retail Sales within the City of Portland imposed on Large Retailers. The December 2020 total local sales tax rate was also.

All businesses must register Registration form or register online If you qualify for. Fast Easy Tax Solutions. The sales tax jurisdiction name.

Oregon has no sales tax. The New Oregon and Portland Taxes on Gross Receipts. The Portland sales tax rate is.

The company conducted more than 200. OR Sales Tax Rate. The minimum combined 2022 sales tax rate for Portland Oregon is.

Portland Oregon Learn About Life In And Around Portland Or Usa Pela

Navigate Portland S Gross Receipts Tax On Large Retailers

Navigating New Sales Tax Rules In The Era Of Online Shopping Marketplace

12 Best Oregon Coast Stops For Your Road Trip In 2020 Oregon Coast Oregon Travel Portland Travel Guide

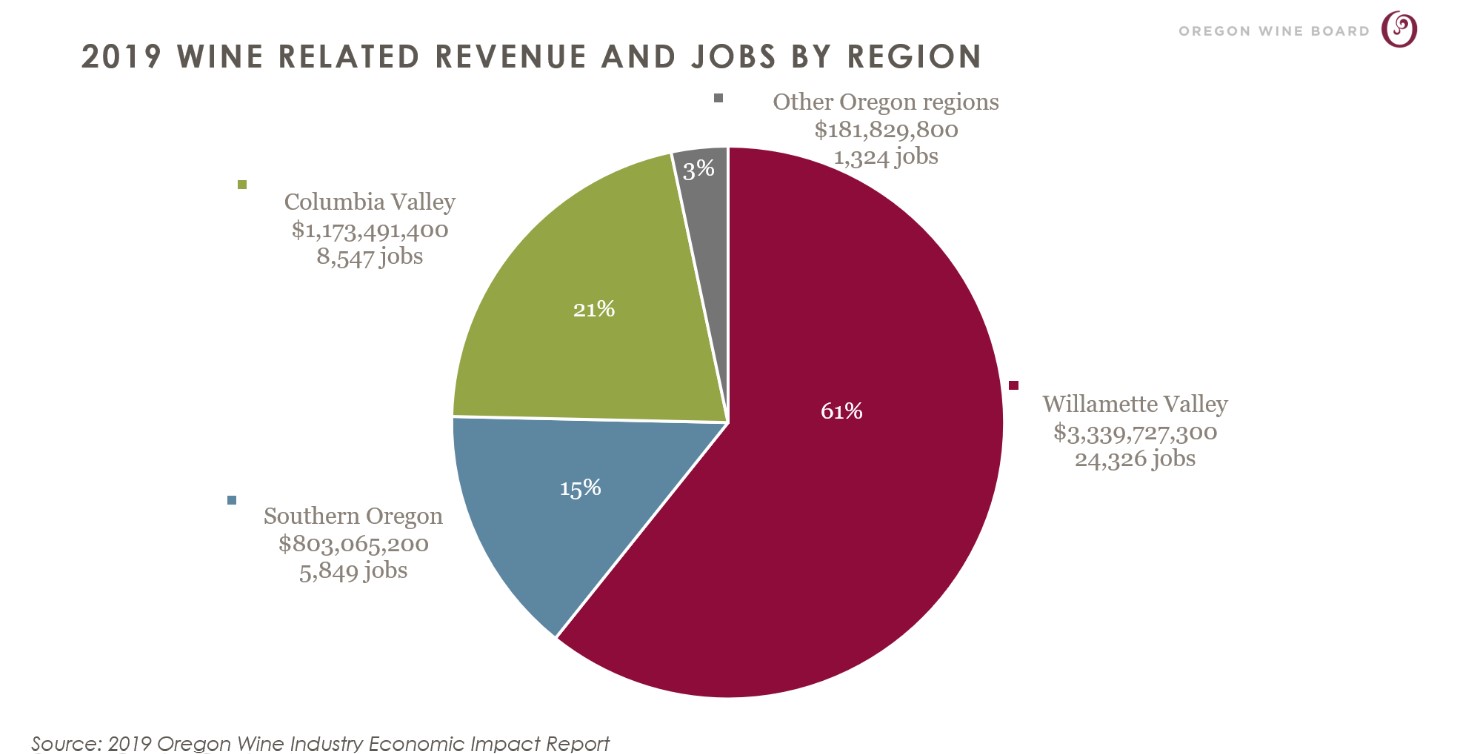

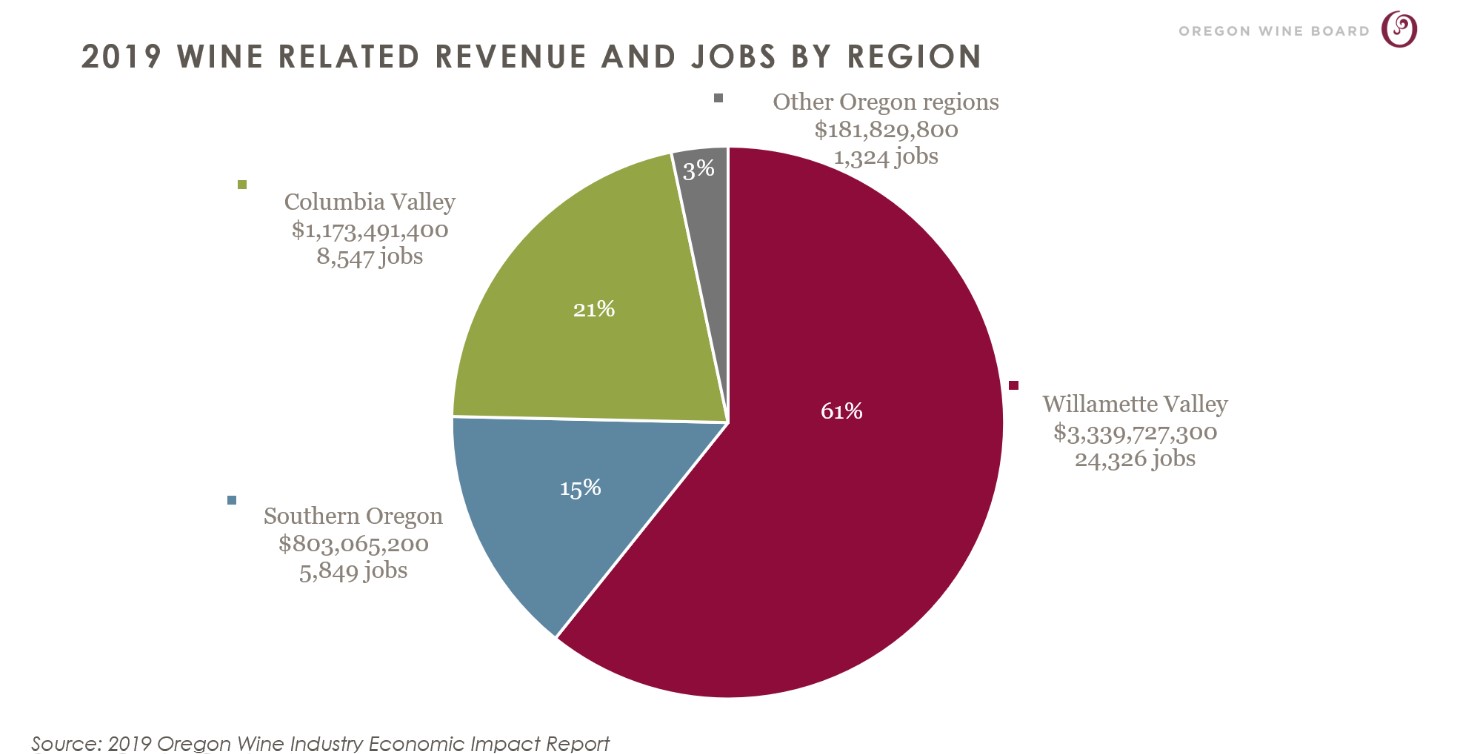

Oregon Wine Industry Continued On Its Long Term Growth Trajectory In 2019 But Encountered Headwinds In 2020 Oregon Wine Industry

How Tax Evasion Fuels Traffic Congestion In Portland City Observatory

Pin By Katie Sharon On Pacific Northwest Trip Rental Quotes Rv Quotes Cruise America

Cost Of Living In Portland Oregon Smartasset

States With Highest And Lowest Sales Tax Rates

Migration To Oregon An Update Oregon Office Of Economic Analysis

Oregon Economic And Revenue Forecast December 2019 Oregon Office Of Economic Analysis Economic Analysis Oregon Forecast

A Better Reality For Oregonians Requires Flipping The Tax System Oregon Center For Public Policy

What Living In Portland Is Like Is Moving To Portland A Good Idea

81st Annual Nhrma Conference Tradeshow Northwest Human Resource Management Association

Portland Oregon Office Of Economic Analysis

Oregon State 2022 Taxes Forbes Advisor